- The 2022 tax changes and how these could alter your retirement plan.

- Social Security is giving a raise in 2022. But what if this pushes you into a higher tax bracket?

- Ways to potentially protect yourself against volatile market conditions.

- The changing rules for a retiring generation of Baby Boomers.

- How loss deductions may affect your taxes in retirement.

- Common misconceptions about taxes in retirement.

- Possible tools and strategies available to retirees to help develop a retirement tax strategy.

- A basic overview of the tax rules as they apply today.

- Strategies to help protect yourself against the taxation of your Social Security income.

- How rising taxes may affect your retirement cash flow.

Space is limited, so sign up today!

No Charge to Attend!

THE NEW TAX AND FINANCIAL RULES HAVE CHANGED.

Understand the potential impact taxes have on your retirement income and learn how the new tax and financial rules could affect you. Whether you’re nearing retirement or already retired, it’s essential to understand how taxes impact your retirement income, and with our on-demand webinar, you can do just that.

Since each person’s tax situation is unique, and the tax rules can change year to year, it can be challenging to get accurate and timely information. That is why we’ve developed a special on-demand webinar that has already helped thousands of people nationwide navigate the retirement tax maze.

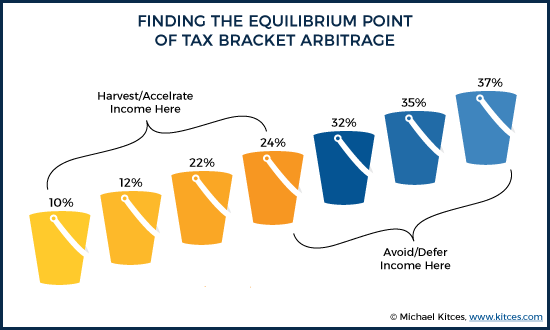

Join our on-demand webinar covering Taxes In Retirement and equip yourself with the most up-to-date and comprehensive information regarding retirement taxation. Learn how to efficiently harvest your income sources, including Social Security, 401(k)/IRA, other sources, or a combination of them all.

Using the information you’ll learn during the on-demand webinar, you’ll be better positioned to develop a successful retirement tax strategy that can potentially safeguard you from over-taxation – all with the goal of saving you money. Sign up now to access the on-demand webinar at your convenience.

This presentation is strictly informational. No investments will be promoted. However, the Financial Professional presenting may invite you to a follow up consultation where financial products may be presented or offered. This presentation has not been endorsed by the Social Security Administration. Neither Taxes In Retirement 567 nor the Financial Professional presenting this seminar are affiliated with the Social Security Administration or any other governmental organization.

By registering, you agree to our Privacy Policy.

Financial professionals do not provide specific tax/legal advice and the information presented at this seminar should not be considered as such. You should always consult your tax/legal advisor regarding your own specific tax/legal situation.